Now, let's go through the process step-by-step.

If a person is going to own a home for more than 10 years, an ARM can be risky! Because they are risky, adjustable rate mortgage loans often have lower initial interest rates (which is why people seem to like them).Īnother reason an adjustable rate mortgage might be desirable is if the interest If a person knows they are going to sell a home after 7 years, then a 5/1 or 7/1 ARM might be desirable.

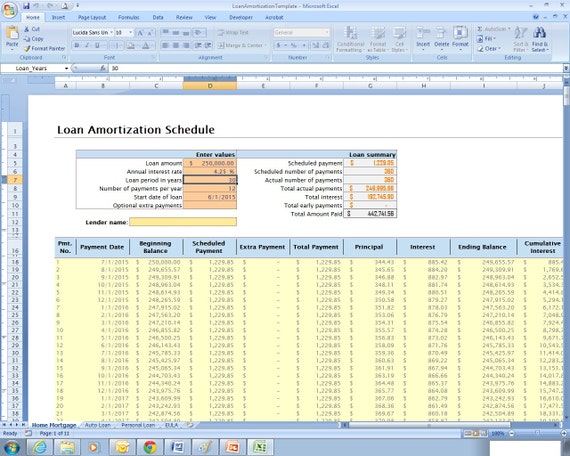

If a home is purchased during a period in which interest rates are extremely low, you might expect the rates to gradually increase. This means that your monthly payment can change! After that, the interest rate can adjust at a frequency of once per year. A 5/1 ARM means the interest rate remains fixed for 5 years (60 months). There are many types of ARMs, but this spreadsheet provides a way to calculate estimated payments for a Fully Amortizing ARM (the most common type of ARM). What is an Adjustable Rate Mortgage (ARM)? You can also edit the interest rate to be used for calculating the interest each month. The actual payment should only be the principal+interest portion (the spreadsheet does not track fees or escrow). When you enter the Actual Payment, the extra payment column is calculated for you. The date the payment is received or paid is just for reference (interest is not prorated based on the date paid). In this new version (added ), columns have been added for basic payment tracking.

0 kommentar(er)

0 kommentar(er)